How to File a Trip Delay Claim and Get Reimbursed FAST- CHASE

Trip Delay Compensation

Flight delays can be frustrating but travel interruption doesn’t have to trigger a full-blown meltdown. You may still be irked by the inconvenience but here's the good news; if you pay with the right credit card, you may be entitled to Trip Delay Reimbursement of up to $500 per ticket. Instead of crashing at the airport while stranded, check into your preferred hotel, splurge on room service and raid the minibar.

If you’re confused about how to file and submit a Trip Delay claim and what the compensation covers, this guide will walk you through the steps to get reimbursed for your expenses fast.

Never Buy a Ticket Without Insurance

You can buy inexpensive one-trip or annual travel insurance via providers like Allianz but it may be a hidden perk that your credit card already offers. Inquire to see if your current card offers the Trip Delay benefit (this is different than Trip Cancellation/ Interruption Insurance) or consider applying for one of the travel-friendly cards listed below.

Several travel credit cards offer Trip Delay coverage. Your card may not be listed here but you might have protection- call your card provider to check if you're covered! The benefit terms vary by card but most pay up to $500 after a six or twelve hour delay. *Check the Benefits Guide for your credit card for terms and conditions.

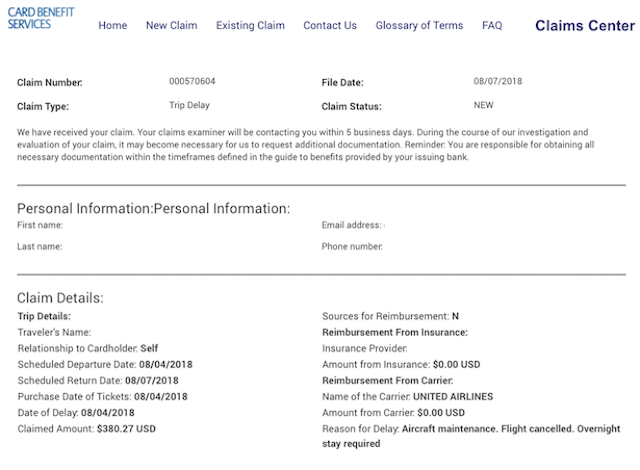

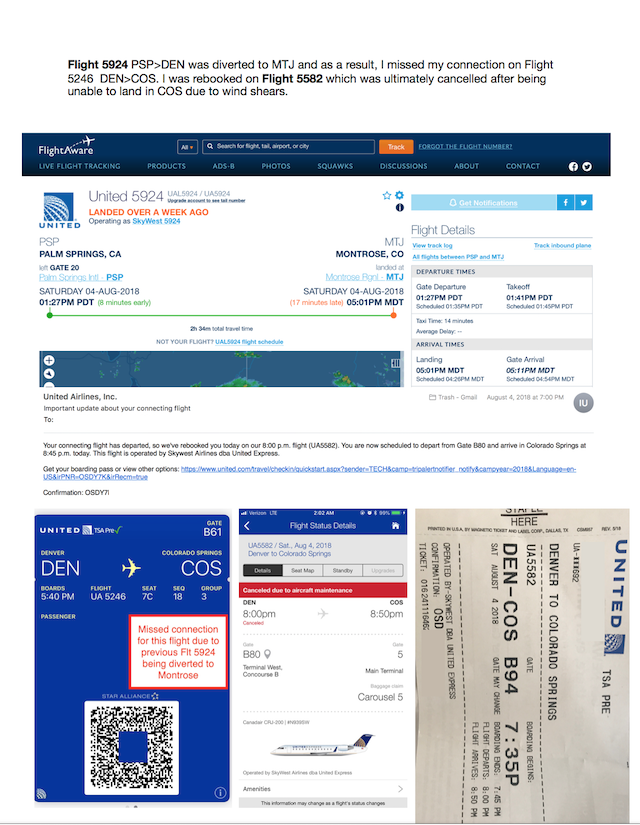

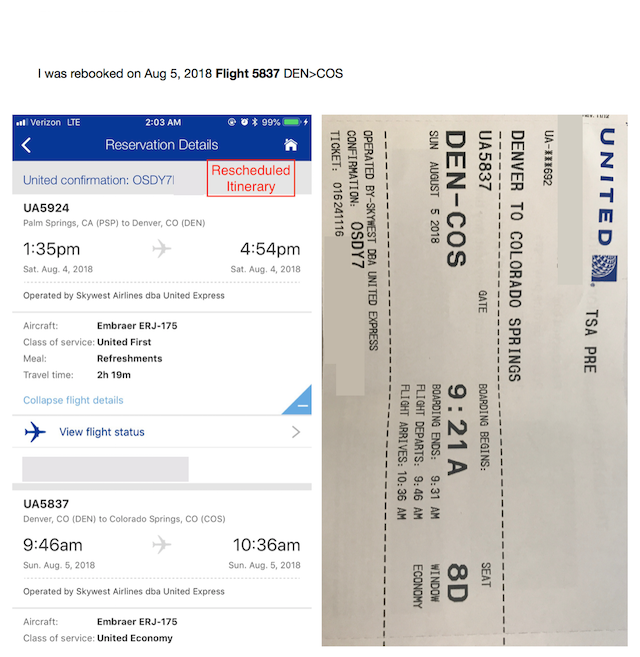

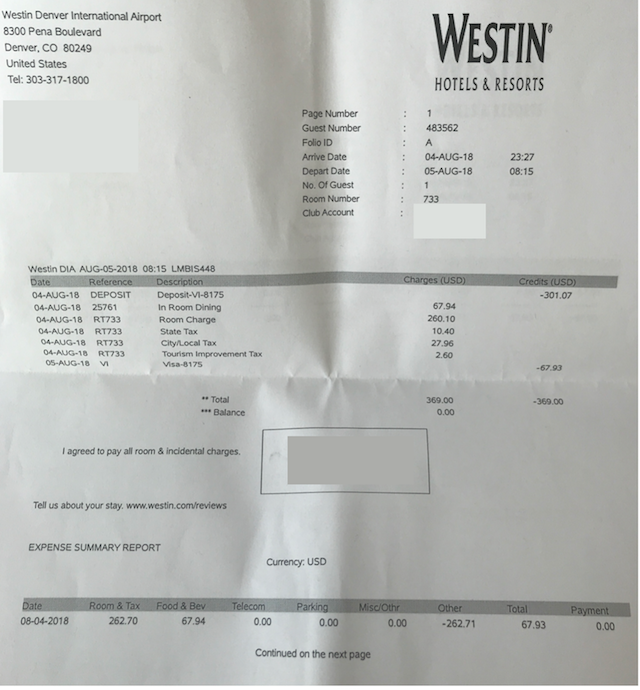

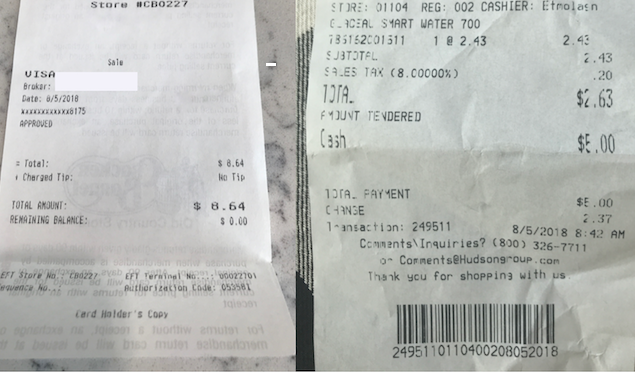

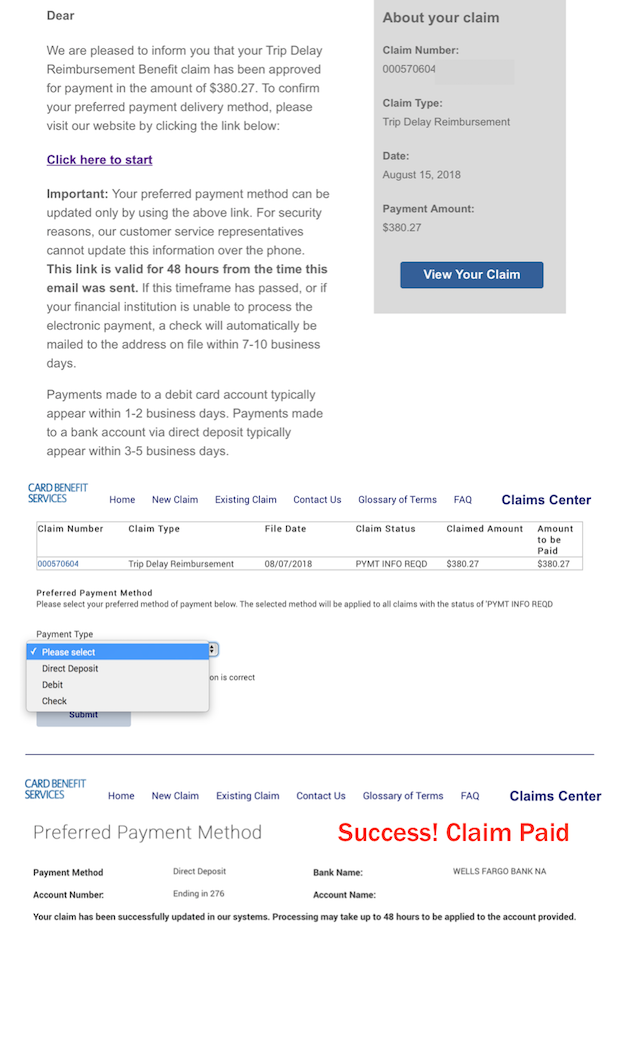

For this example, the Chase Sapphire Reserve Card was used to purchase an airline ticket and the opportunity to test the Trip Delay benefit presented itself after a 16 hour delay in Denver. A one night stay at the swanky Westin DIA with room service and a couple of incidentals totaling $380.27 were 100% reimbursed.

The Chase Sapphire Reserve card is one of the top travel reward cards loaded with a wealth of perks for the frequent traveler, like access to Priority Pass airport lounges, which can ease your suffering during shorter delays. Utilizing the $500 Trip Delay protection just once per year more than justifies the card’s $450 annual fee.

The benefit terms outlined below are specific to Chase but may be similar for your card. *Check the Benefits Guide for your credit card for terms and conditions.

“Trip Delay benefits are superior to any compensation most Common Carriers will provide in the United States. Airlines may toss you a $10 meal voucher or a discounted motel accommodation for cancelled flights, provided the cause was equipment/maintenance related but they are not responsible for weather delays. Under EU regulation 261/2004 European travelers may be entitled to compensation from the carrier if a scheduled flight arrives more than three hours after scheduled arrival time. Trip Delay Reimbursement is secondary and kicks in after reimbursements supplied by the airline or other insurers.”

Who is Covered?

The following are automatically covered when a portion or the entire cost of the Common Carrier fare, is purchased with your Chase credit card account (“Account”).

You, a person to whom a United States (U.S.) credit card has been issued (“Cardholder”)

Your spouse

Your dependent children under twenty-two (22) years of age

What Expenses are Covered?

You are covered for reasonable additional expenses, including but not limited to:

Meals

Lodging

Toiletries

Medication

Other personal use items that you encounter due to a Covered Hazard delay, as long as the services were not provided free of charge by the Common Carrier

What is a Covered Hazard/Reason for Delay?

Equipment failure

Delays due to inclement weather

Labor strikes

Hijacking or skyjacking

What is NOT Covered?

You are not covered for any delay that was made public or known to you prior to the departure for the Covered Trip. Also, prepaid expenses are not covered under Trip Delay but may be covered if you have Trip Interruption/Cancellation insurance.

If your trip is delayed but you are departing from the city of your primary residence, were given advance notice of the delay, or acquired travel insurance after notification of delay, your claim will be undoubtedly be denied.

Alcohol and gratuities may not be reimbursed if you are asked to submit itemized charge receipts. Some travelers have been successfully reimbursed if alcohol and gratuities were charged to a hotel room and the hotel folio was submitted as a receipt.

This coverage isn’t just limited to flights. It applies to any land, water, or air conveyance that operates under a valid license to transport passengers for hire and requires purchasing a ticket before travel begins. It does not include taxis, limousine services, commuter rail or bus lines, or rental vehicles. Make sure to book all of your travel/transportation tickets on a covered card.

Bookings from third parties such as Expedia or Orbitz are covered, as long as you paid a portion or the entire cost of the Common Carrier fare with your eligible account. It’s fine if you used an award to book a ticket, as long as the taxes, fees, baggage charges or upgrades were charged to your covered card.

These are the exact steps that resulted in a successfully processed claim and direct deposit payment in seven business days from the date claim was submitted. Again, I used the Chase Sapphire Reserve card for airfare, so that is the experience I’m sharing but these steps can be followed for most Trip Delay Claims.

Step 1 | Organize Your Documents

Begin recording trip delay notifications, rescheduled itinerary, boarding passes -take screenshots of everything from the moment the trip is delayed. Keep all itemized and charge receipts for delay related expenses and organize your documents. It will become exponentially more laborious to gather these items after the fact. Online delay notifications are usually available on the day of travel or 24 hours after a scheduled segment. FlightAware and FlightStats are some of the apps you can use if you need historical flight data.

Note: If you don't mind waiting in the customer service line, ask for a Statement of Delay from the carrier once they've sorted out your rescheduled itinerary. If you'd rather skip the lines, be free! Rebook your own segment online and you can get the Statement of Delay from Common Carrier later, as outlined in Step 3.

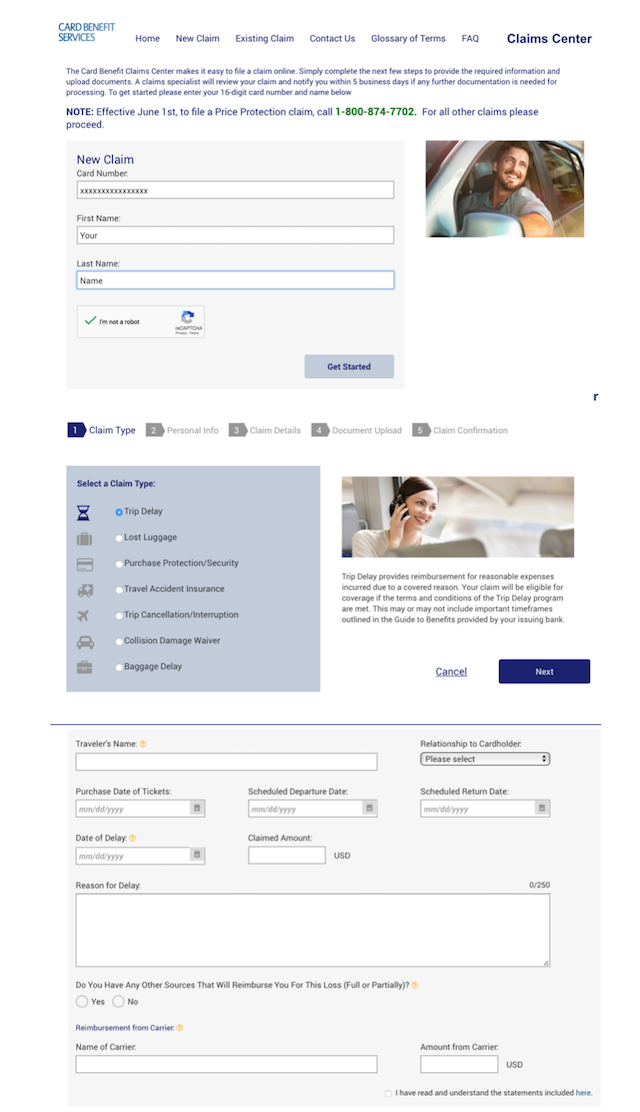

Step 2| Complete Online Claim Form

Chase customers can start a new claim at eclaimsline.com within 60 days of trip delay.

The Chase Sapphire Reserve benefit guide says to call the Benefit Administrator at 1-800-253-5664 within 60 days of the date of delay to file a claim but you can skip that step for now, unless you need things snail mailed to you. You will need to call and follow up if the examiner starts requesting additional documents or asks for things you've already submitted. The completed claim form and requested documentation must be submitted within 100 days of the trip delay.

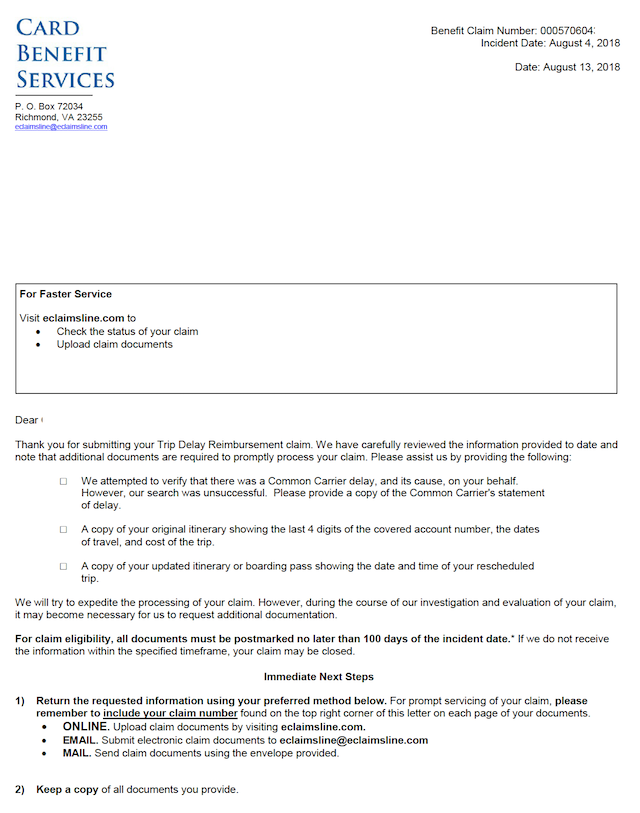

Step 3| Submit Required Documents

Required Documents:

Completed claim form

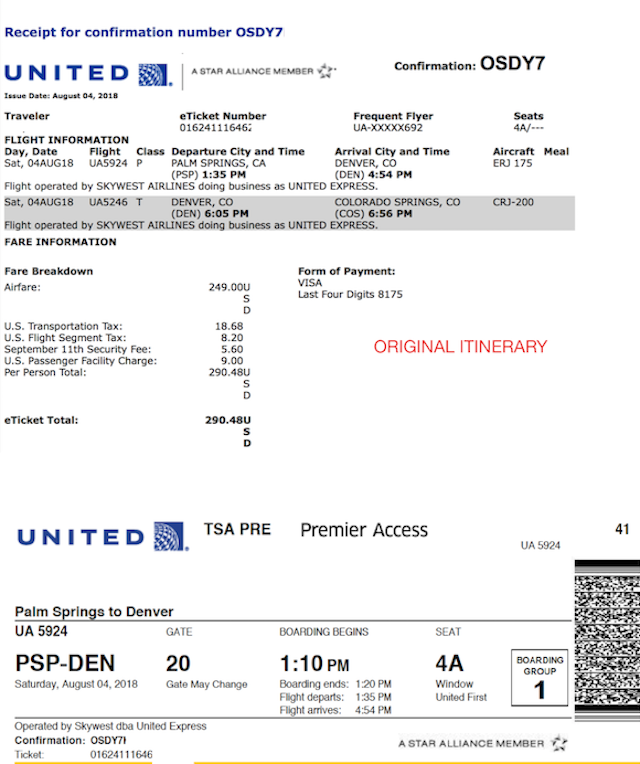

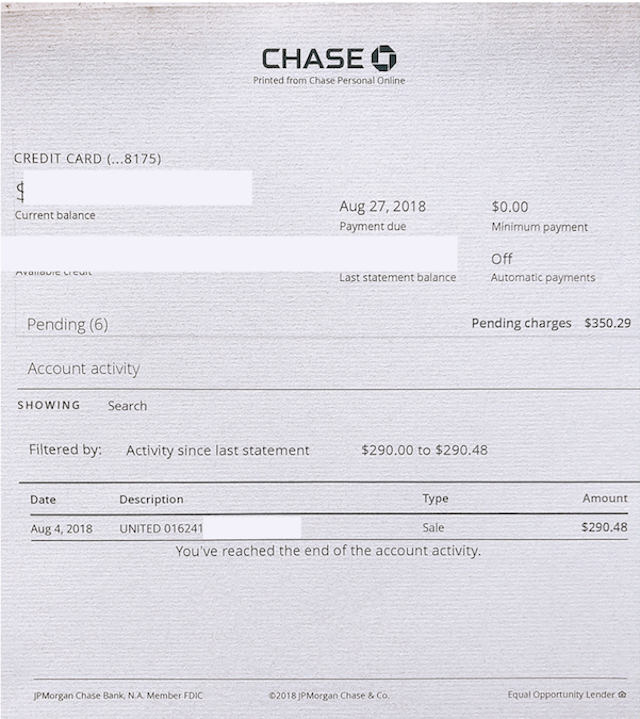

Common Carrier ticket/ original receipt showing the fare was booked with the covered credit card (last 4 digits of card must be shown on this document)

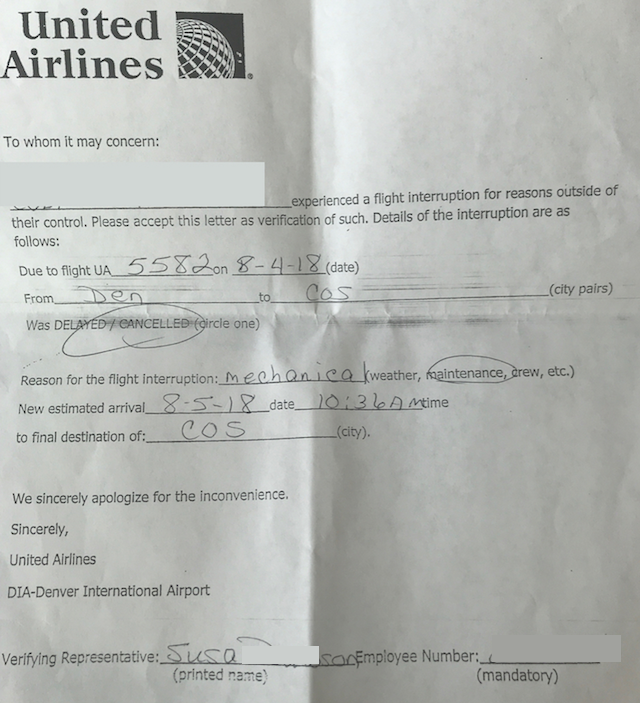

Statement of Delay from the Common Carrier indicating the reasons that the Covered Trip was delayed, confirming flight details, whether the flight was cancelled or delayed and most important, the reason for delay. Keep in mind that only certain reasons are covered; the letter from the carrier must site a covered reason for delay. It’s best to obtain this from the customer service desk before leaving the terminal but you can request it via email from the airlines or ask the gate agent.

Itemized receipts for all expenses incurred due to the delay, including but not limited to accommodations, transport, meals and other personal items. The benefits guide terms state that for meals under $50, the non-itemized charge receipt is acceptable. However, the claims examiner will almost always request itemized receipts, so it’s more efficient to submit them in the neat and tidy PDF you’re going to send to the claims examiner.

Note: You don’t need to pay for these expenses with the card providing the Trip Delay protection. In rare instances, a credit card statement may be requested in addition to receipts for delay related expenses, so it may be easier to charge them all to one card.

Credit card statement showing fare booked on covered card (take a screenshot of your online account, you don’t have to wait for your monthly statement)

If you booked with award miles or points, a screenshot of the award transaction

Rebooked itinerary / itinerary as flown (keep boarding passes as they may be requested as additional documents)

Proof of "round trip" airfare (meaning departing from and eventually returning to your primary residence) that doesn’t exceed three hundred and sixty- five (365) days away from your residence to a destination other than your city of residence. *The ticket does not have to be purchased as a round trip (one-ways are fine), nor does travel need to be on the same carrier, as long as the return is to your primary residence

Any other documentation deemed necessary to substantiate the claim

Submit the required documents via the upload portal. There is a file size limit via the upload portal, so if you don't want to go through the hassle of resizing your images, compile all your documents into one organized PDF, add your claim number to each page and email the PDF to eclaimsline@eclaimsline.com. Sending this back up copy will also be useful if the examiner starts giving you the run around and asks for documents you've already sent in.

Step 4 | Wait for Results, Get Paid!

If you followed this guide and completed your claim submission, you should receive an email within five (5) business days. If you don't receive a status update, call 1-800-253-5664. The claims examiner may request additional documents (see below) but you've been meticulous with your submission, so now's the time call 1-800-253-5664 and ask to speak to your examiner (the frontline folks that answer the phone may not have all of your claim details). Give them your claim number and the date you submitted your documents.

Research notes:

The term "reasonable expenses" is subjective. Some travelers have reported keeping their expenses modest and not paying more than $100 for a hotel. Others have reported staying at 5 star hotels and were fully reimbursed. Use your discretion. Maybe take a peek at this Reddit thread to get an idea of what others have successfully claimed and what has been denied.

Reimbursement for gratuities are a grey area but seem to be denied quite often. Keep that in mind if you only tip like a baller when it's someone else's dime.